ChatGPT is a powerful conversational AI model that can interact with humans in natural language. It can generate responses to a variety of queries, from factual information to creative content.

But what does ChatGPT mean for the accounting profession?

How can it help accountants to improve their efficiency, accuracy, and creativity?

What are the challenges and risks of using ChatGPT in accounting?

What are the ethical and social implications of this technology for the accounting field and society at large?

In this blog post, we will explore some of the ways that ChatGPT can assist accountants with various accounting tasks and processes.

We will also discuss some of the benefits and challenges of using ChatGPT for accounting purposes.

What is ChatGPT

OpenAI developed ChatGPT, a natural language generation (NLG) tool that produces text from a given prompt.

It runs on generative pre-trained transformer (GPT) models, which are large language models (LLMs) that power ChatGPT.

The latest ChatGPT version, which came out in May 2023, uses GPT-4 as its engine.

The previous version, which came out in November 2022, uses GPT-3.5. ChatGPT has amazed the world since November 2022.

This amazing AI chatbot can generate human-like responses on various topics by understanding natural language prompts. However many users have not explored ChatGPT’s full potential yet.

You can use the right prompts and techniques to get more value from this powerful AI assistant.

It is revolutionizing every field of work and life. In the accounting field, it is making the work of accountants easy and making them more productive.

What is Accounting

The accounting field is the industry that deals with recording and reporting the financial transactions of an organization.

Accounting is also a field of study and profession that involves applying accounting principles and standards to measure, analyze, and communicate financial information to various stakeholders, such as investors, creditors, managers, and regulators.

Types of Accounting

Different types of accounting serve different purposes and audiences. Some of the most common types of accounting are:

Financial Accounting

This type of accounting focuses on preparing and presenting financial statements that follow the Generally Accepted Accounting Principles (GAAP) or the International Financial Reporting Standards (IFRS).

Financial accounting is mainly for external users who need to evaluate the financial performance and position of an organization.

Managerial Accounting

This type of accounting focuses on providing relevant and timely information for internal users who need to make decisions and plan for the future of an organization.

Managerial accounting is not bound by GAAP or IFRS but by the needs of the managers.

Cost Accounting

This type of accounting focuses on tracking, analyzing, and reporting the costs of producing goods or services.

Cost accounting helps managers to control costs, optimize resources, and set prices.

Tax Accounting

This type of accounting focuses on preparing and filing tax returns and complying with tax laws and regulations. Tax accountants help individuals and organizations to minimize their tax liabilities and avoid penalties.

Auditing

This type of accounting focuses on examining and verifying the accuracy and reliability of financial statements and other information.

Auditors can be internal or external, depending on whether they work for the organization or an independent firm.

Forensic Accounting

This type of accounting focuses on investigating and resolving financial fraud, disputes, or litigation.

Forensic accountants use their accounting skills and knowledge to collect evidence, analyze data, and provide expert testimony in court.

How ChatGPT Can Help Accountants

ChatGPT can help accountants with various aspects of their work, such as:

Data Entry

ChatGPT can help accountants enter and analyze data faster and more accurately.

For example, ChatGPT can generate journal entries based on transaction descriptions, or create financial statements based on trial balances.

ChatGPT can also perform calculations, such as ratios, variances, or projections, based on the data provided.

Data Analysis and Decision-Making

Another important task for accountants is data analysis and decision-making. Accountants need to analyze large volumes of data to identify trends, patterns, risks, opportunities, and insights.

ChatGPT can assist accountants in this task by performing calculations, statistical analysis, and data visualization. It can also generate reports and narratives based on the data analysis.

For example, a user can prompt ChatGPT with something like: “Act as an accountant.

Can you analyze the sales data for the last quarter and provide me with a summary report?” ChatGPT will then generate a response like:

“Sure, I can do that. Here is the summary report:

The total sales for the last quarter were $10 million, which is a 10% increase from the previous quarter.

The most profitable product was Product A, which accounted for 40% of the total sales and had a 50% profit margin.

The least profitable product was Product C, which accounted for 10% of the total sales and had a 10% profit margin.

The main drivers of sales growth were increased customer demand, improved marketing strategies, and new product launches.

The main challenges were rising production costs, competitive pressure, and supply chain disruptions.

Based on this analysis, I recommend that you:

Increase the price of Product C or discontinue it if it is not profitable.

Invest more in marketing Product A to maintain its market share and profitability.

Explore new markets and channels for Product B to increase its sales potential.

Reduce production costs by optimizing processes and sourcing cheaper materials.

Strengthen your supply chain by diversifying your suppliers and increasing your inventory.”

This way, ChatGPT can help accountants with data analysis and decision-making by providing them with relevant information, insights, and recommendations.

Report Writing

ChatGPT can help accountants write clear and concise reports based on the data and analysis.

For example, ChatGPT can generate audit reports based on audit evidence and findings, or management reports based on financial performance and recommendations.

ChatGPT can also format the reports according to the desired style and standards.

Research and Learning

ChatGPT can help accountants research and learn about various accounting topics and issues.

For example, ChatGPT can answer questions about accounting standards, rules, or best practices, or provide summaries of relevant articles or publications.

ChatGPT can also help accountants keep up with the latest trends and developments in the accounting field.

Invoice Processing and Expense Categorization

One of the most tedious and time-consuming tasks for accountants is processing invoices and categorizing expenses.

ChatGPT can help automate this task by analyzing invoices and extracting relevant information, such as invoice number, due date, amount, and vendor details.

It can also categorize expenses based on predefined categories, such as rent, utilities, office supplies, and travel expenses.

For example, a user can prompt ChatGPT with something like: “Act as an accountant. Can you help me categorize expenses from a credit card statement if I provide you with vendors’ names and amounts?” ChatGPT will then generate a response like:

“Sure, I can help you with that. Here are the categories for your expenses:

Rent: $1,500

Utilities: $200

Office supplies: $100

Travel expenses: $300

Total: $2,100″

This way, ChatGPT can save accountants time and effort in processing invoices and expenses, and reduce the risk of errors and commissions.

Communication and Collaboration

ChatGPT can help accountants communicate and collaborate with their clients, colleagues, or supervisors.

For example, ChatGPT can generate emails or messages based on the purpose and tone of the communication, or provide feedback or suggestions based on the content of the communication.

ChatGPT can also facilitate group discussions or brainstorming sessions by generating ideas or questions.

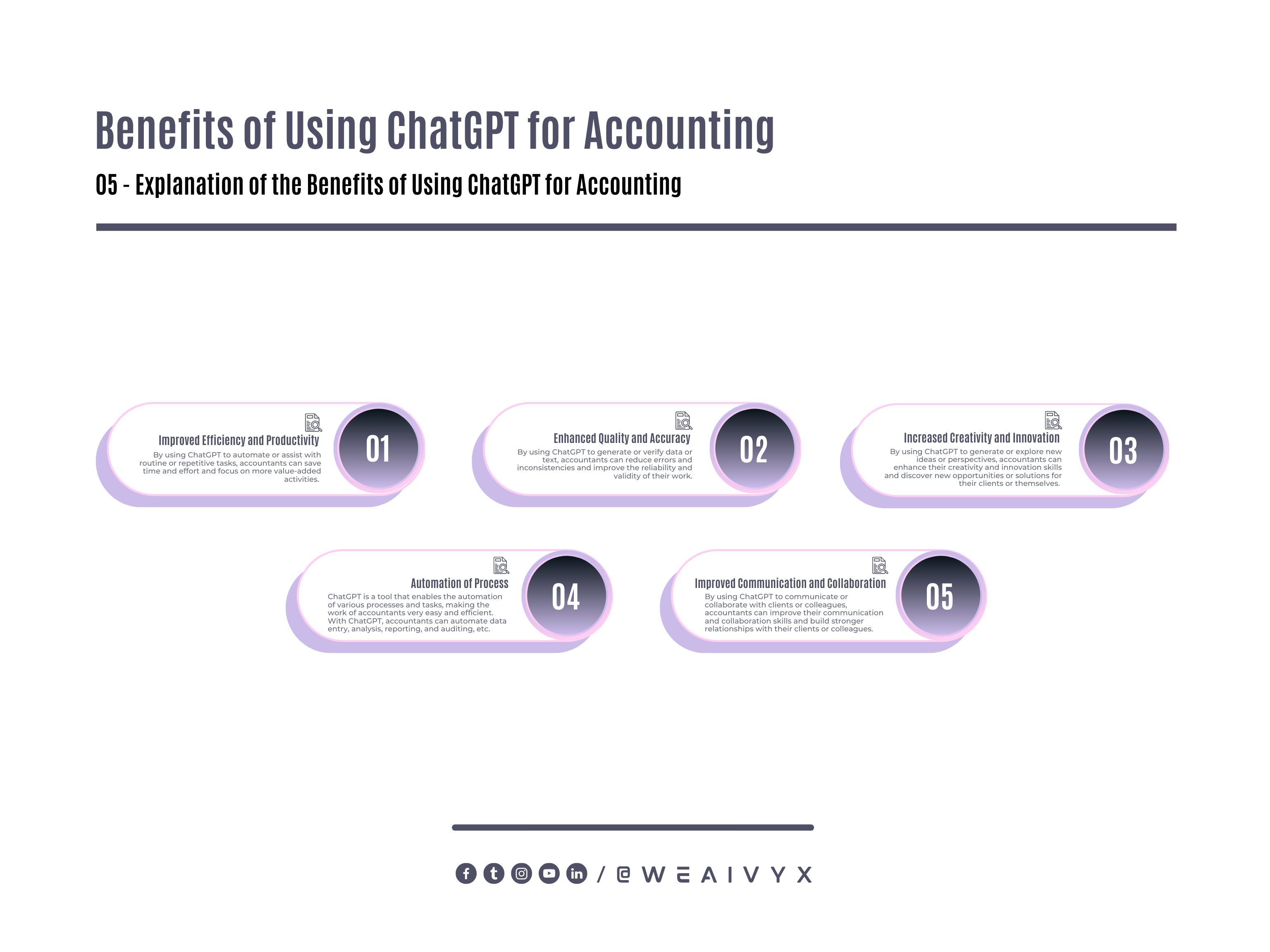

Benefits of Using ChatGPT for Accounting

Using ChatGPT for accounting can bring several benefits to accountants and their clients, such as:

Improved Efficiency and Productivity

By using ChatGPT to automate or assist with routine or repetitive tasks, accountants can save time and effort and focus on more value-added activities.

This can also reduce the workload and stress for accountants and improve their work-life balance.

For example, ChatGPT can help accountants with data entry, bookkeeping, invoice generation, tax preparation, report writing, and more.

ChatGPT can also handle multiple queries or requests from different clients simultaneously, which can increase the responsiveness and availability of accountants.

Enhanced Quality and Accuracy

By using ChatGPT to generate or verify data or text, accountants can reduce errors and inconsistencies and improve the reliability and validity of their work.

This can also increase the confidence and satisfaction of their clients and stakeholders.

For example, ChatGPT can help accountants with data analysis, auditing, fraud detection, compliance checking, quality assurance, and more.

ChatGPT can also use natural language processing and machine learning to understand the context and intent of the data or text and provide relevant and accurate information or feedback.

Research explores how AI impacts audit quality and efficiency using a unique dataset of more than 310,000 detailed individual resumes for the 36 largest audit firms.

Increased Creativity and Innovation

By using ChatGPT to generate or explore new ideas or perspectives, accountants can enhance their creativity and innovation skills and discover new opportunities or solutions for their clients or themselves.

This can also foster a culture of learning and growth for accountants.

For example, ChatGPT can help accountants with scenario planning, forecasting, budgeting, strategy development, business modeling, and more.

ChatGPT can also use natural language generation and deep learning to produce original and diverse content or suggestions that can inspire or challenge accountants.

Automation of Process

ChatGPT is a tool that enables the automation of various processes and tasks, making the work of accountants very easy and efficient.

With ChatGPT, accountants can automate data entry, analysis, reporting, and auditing, among other things.

ChatGPT can also manage and monitor multiple processes, saving a lot of time and resources. ChatGPT is a smart and powerful tool that can transform the accounting profession.

Improved Communication and Collaboration

By using ChatGPT to communicate or collaborate with clients or colleagues, accountants can improve their communication and collaboration skills and build stronger relationships with their clients or colleagues.

This can also enhance the reputation and influence of accountants.

For example, ChatGPT can help accountants with chat support, email writing, presentation creation, feedback collection, team coordination, and more.

ChatGPT can also use natural language understanding and sentiment analysis to adapt to the tone and style of the communication or collaboration partner and provide appropriate and empathetic responses or inputs.

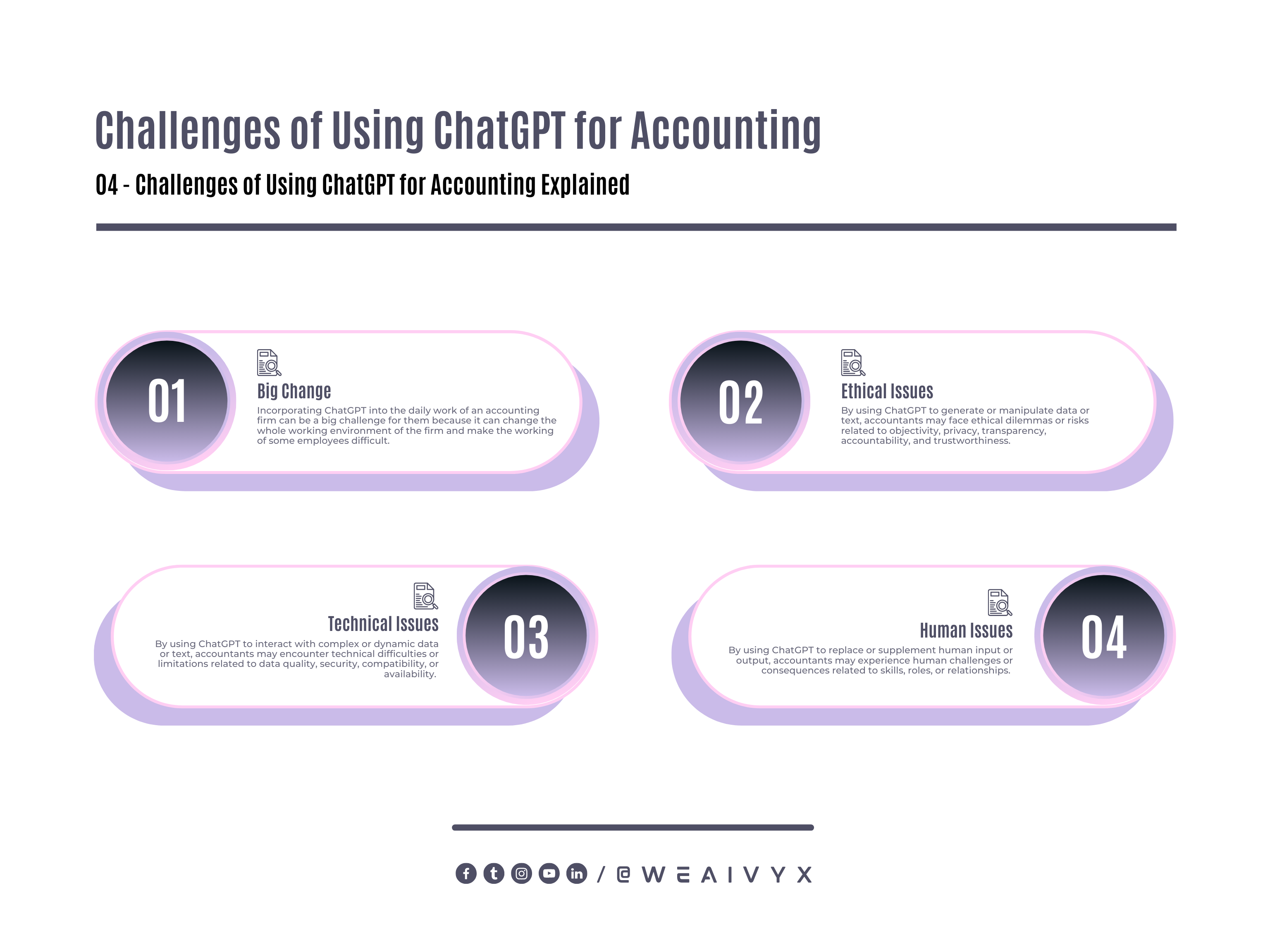

Challenges of Using ChatGPT for Accounting

Using ChatGPT for accounting also poses some challenges that accountants need to be aware of and address, such as:

Big Change

Incorporating ChatGPT into the daily work of an accounting firm can be a big challenge for them because it can change the whole working environment of the firm and make the working of some employees difficult.

Employees will have to come out of their comfort zone and again learn the whole new process.

Ethical Issues

By using ChatGPT to generate or manipulate data or text, accountants may face ethical dilemmas or risks related to objectivity, privacy, transparency, accountability, and trustworthiness.

For example, accountants may be tempted to use ChatGPT to fabricate or conceal information that may affect their clients’ interests or obligations.

Accountants need to adhere to the ethical principles and standards of their profession and ensure that their use of ChatGPT is honest, fair, and responsible.

Technical Issues

By using ChatGPT to interact with complex or dynamic data or text, accountants may encounter technical difficulties or limitations related to data quality, security, compatibility, or availability.

For example, accountants may face challenges in ensuring that the data they use or generate with ChatGPT is accurate, complete, relevant, secure, consistent, and accessible.

Accountants need to have adequate technical skills and knowledge to use ChatGPT effectively and efficiently and to troubleshoot any problems that may arise.

Human Issues

By using ChatGPT to replace or supplement human input or output, accountants may experience human challenges or consequences related to skills, roles, or relationships.

For example, accountants may need to acquire new skills or competencies to use ChatGPT or to cope with the changes in their work environment or expectations.

Accountants may also need to adjust their roles or responsibilities to collaborate with ChatGPT or to oversee its performance.

Accountants may also need to manage their relationships with their clients, colleagues, or supervisors who may have different views or attitudes toward ChatGPT.

Accountants need to have a positive and proactive mindset to embrace ChatGPT as a partner and a tool for their work and to communicate and cooperate with others effectively and respectfully.

Conclusion

ChatGPT is a powerful tool that can help accountants to improve their efficiency, accuracy, and creativity.

By using ChatGPT in accounting, accountants can save time and reduce workload, improve accuracy and reliability, and enhance creativity and innovation.

However, ChatGPT also has some limitations and challenges that need to be addressed, such as ensuring its ethical and responsible use, integrating it with existing systems and processes, and maintaining human oversight and control.

If you are interested in learning more about ChatGPT and how it can benefit your accounting practice, please visit chat.openai.com and try it out for yourself.”

This way, ChatGPT can help accountants with content creation and communication by providing them with engaging and informative text.

Accounting is a vital function for any business, but it can also be time-consuming, tedious, and error-prone.

Fortunately, there is a new technology that can help accountants streamline their work and improve their efficiency and accuracy: ChatGPT.